Business Insurance in and around Bradley

Bradley! Look no further for small business insurance.

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes commitment, dedication, and great insurance. That's why State Farm offers coverage options like extra liability coverage, a surety or fidelity bond, business continuity plans, and more!

Bradley! Look no further for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a barber shop, an art school or an interior decorator. Agent Marshall Crawford is also a business owner and understands what you need. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

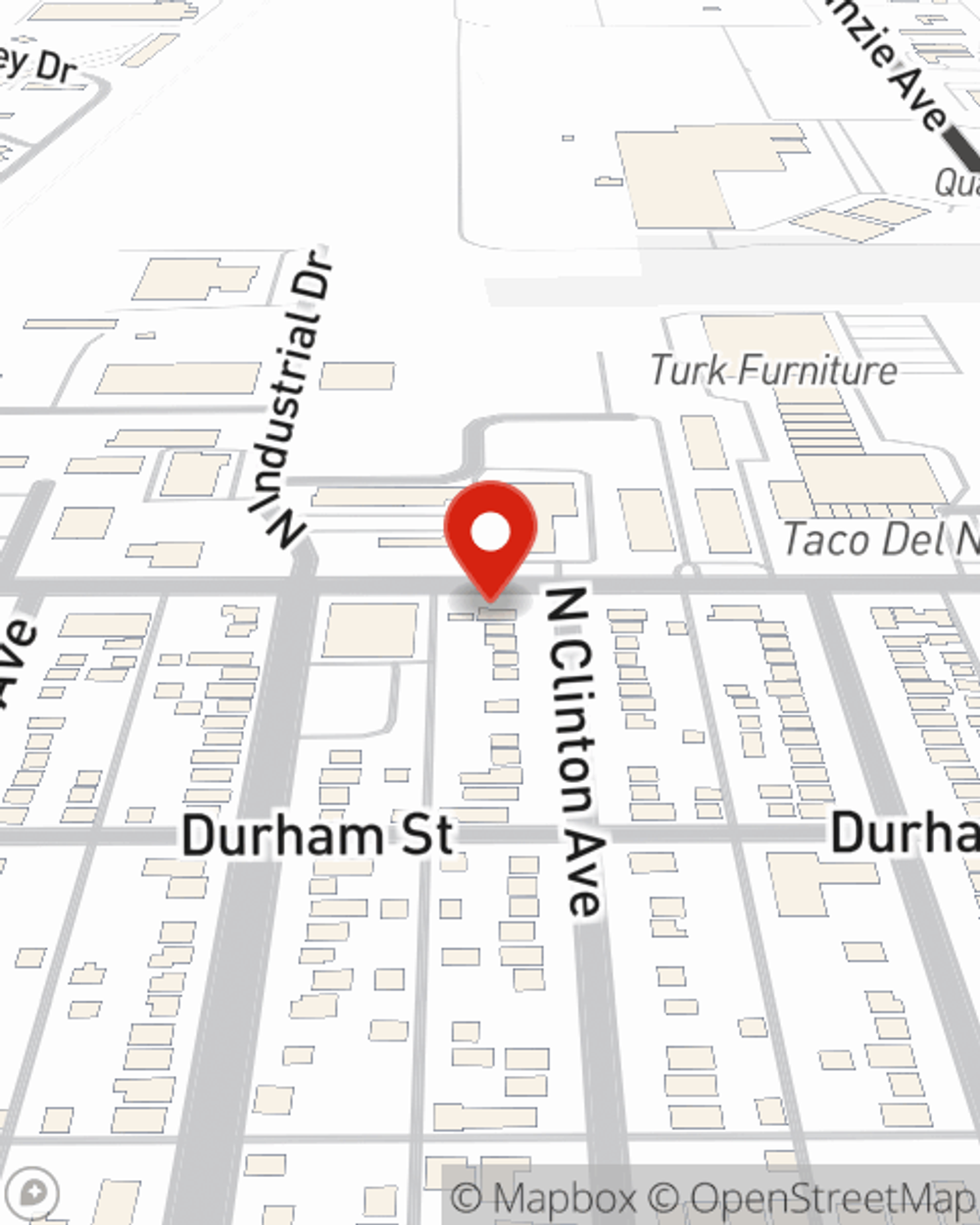

Call Marshall Crawford today, and let's get down to business.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Marshall Crawford

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.